Rural Preservation Program

What is the Rural Preservation Program?

Mission:

The mission of the Rural Preservation Program is to protect and preserve agricultural lands, natural areas and the rural character of the Town of Dunkirk through the acquisition of agricultural and natural area conservation easements.

Goals:

The Rural Preservation Program endeavors to:

Work with willing, eligible landowners to permanently protect their property

Protect and buffer farmland and viable farm operations from the impacts of development

Preserve and buffer significant natural features, scenic vistas, and historic, cultural, and archaeological sites and landscapes from the impacts of development

Create and maintain corridors of protected land

Strategies:

In an effort to fulfill the purpose of the rural preservation program and achieve its goals Dunkirk will:

Partner with organizations for funding to assist in carrying out program goals

Create and sustain partnerships with a variety of organizations with shared goals, principally the Natural Heritage Land Trust

Communicate with residents on a regular basis and provide program information to interested individuals and groups

Purchase the development rights on a voluntary basis from willing owners through the use of conservation easements

Utilize/promote programs that support farmland preservation (DATCP’s Ag Enterprise Areas)

Create Rural Preservation Commission to recommend: application process, selection criteria, easement appraisal process, enforcement/stewardship

Information

Dunkirk July 2018 Survey Information

In an attempt to gauge citizen interest in funding a rural preservation program, the town of Dunkirk mailed a survey to all town residents in July 2018. The survey had a 26.5% response rate. Of that, 70% indicated that they were in favor of a referendum and raising taxes for the program.

General Information

Frequently Asked Questions(source: Town of Dunn)

Other Local Programs

Federal Income Tax

Income Tax Incentives for Land Conservation, Land Trust Alliance

Using the Conservation Tax Incentive, Land Trust Alliance

Estate Tax Incentives for Land Conservation, Land Trust Alliance

Cost of Community Services Studies

Many studies show that agricultural and open space uses greatly reduce the tax burden on residents as compared to residential and commercial uses. Cost of Community Services studies are a case study approach used to determine the fiscal contribution of existing local land uses. The following links are to local studies and studies done in communities across the United States that look at the relationship between revenues generated by various land uses and the tax burden that servicing each use places on the tax payers of a community.

Letters of Support

Information for Initial Landowner Meetings:

Step-by-Step Guide (PDF)

Frequently Asked Questions (PDF)(source: Town of Dunn)

Income Tax Incentives for Land Conservation, Land Trust Alliance

Estate Tax Incentives for Land Conservation, Land Trust Alliance

Program Development History

Over the last 20 years Town Residents have affirmed many times that preserving the rural character of Dunkirk is of high importance. In response to the citizen interest in 2016 a volunteer committee was formed to evaluate possibilities as well as inform and educate residents. The committee was chaired by Ingrid West and included Brett Olson, Bill Delehanty, James Danky, Cindy Diehl and Chris Horton.

On April 2, 2019, Town residents were given the opportunity to vote on whether they would support a plan to fund a program. Residents were specifically asked if they would support an assessment that would be used to build a program that would purchase development rights of land from landowners, preserving the land for agriculture and natural areas.

Town residents approved the program by a significant margin - nearly 62% of Town residents voted in favor and 38% opposed.

Informational Meetings held:

Tuesday, April 2, 2019: Advisory Referendum. Proposal: Shall the town of Dunkirk initiate a program of rural preservation through the purchase of development rights in farmland and natural areas that are voluntarily offered for sale by property owners in the Town, with the program funded by a mill rate increase on all taxable property in the Town of $.50 per $1,000 of equalized valuation?

Sunday, March 31, 2019: Educational Forum on Rural Preservation and proposed Referendum, 2:30-4:30 pm at the Dunkirk Town Hall.

Monday, March 11, 2019: Rural Preservation Monthly Committee meeting 6:30 PM, Dunkirk Town Hall.

March 19, 2017 Educational Forum Presentation

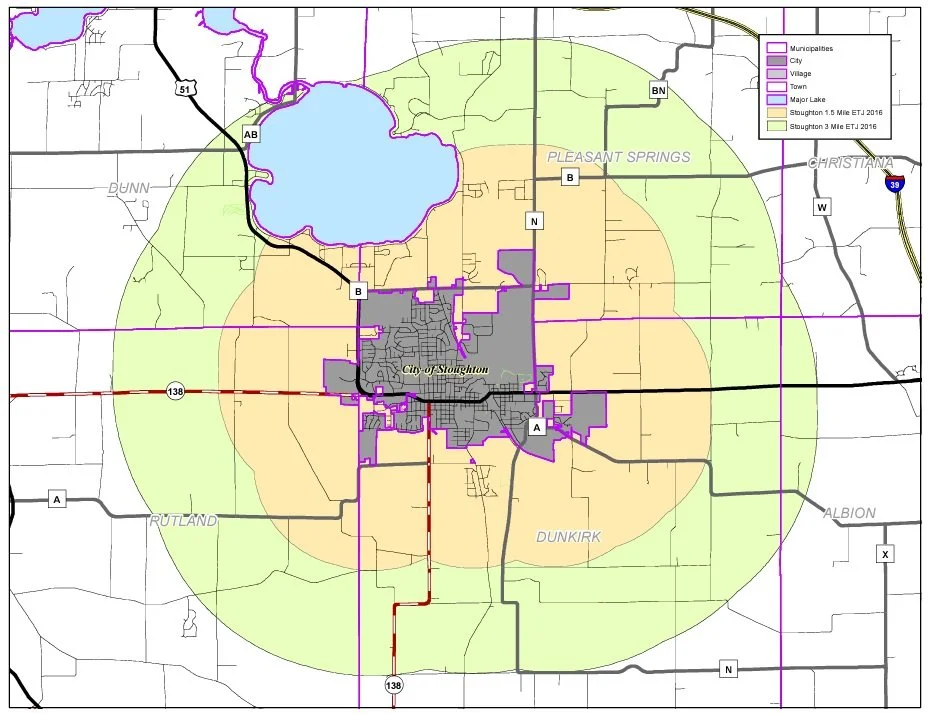

Stoughton Land Use Maps

Click the maps to see the full size map

City of Stoughton Annexations

2000 - 2016

City of Stoughton Comprehensive Plan Map 2016

City of Stoughton Extra-Territorial Jurisdiction Map 2016